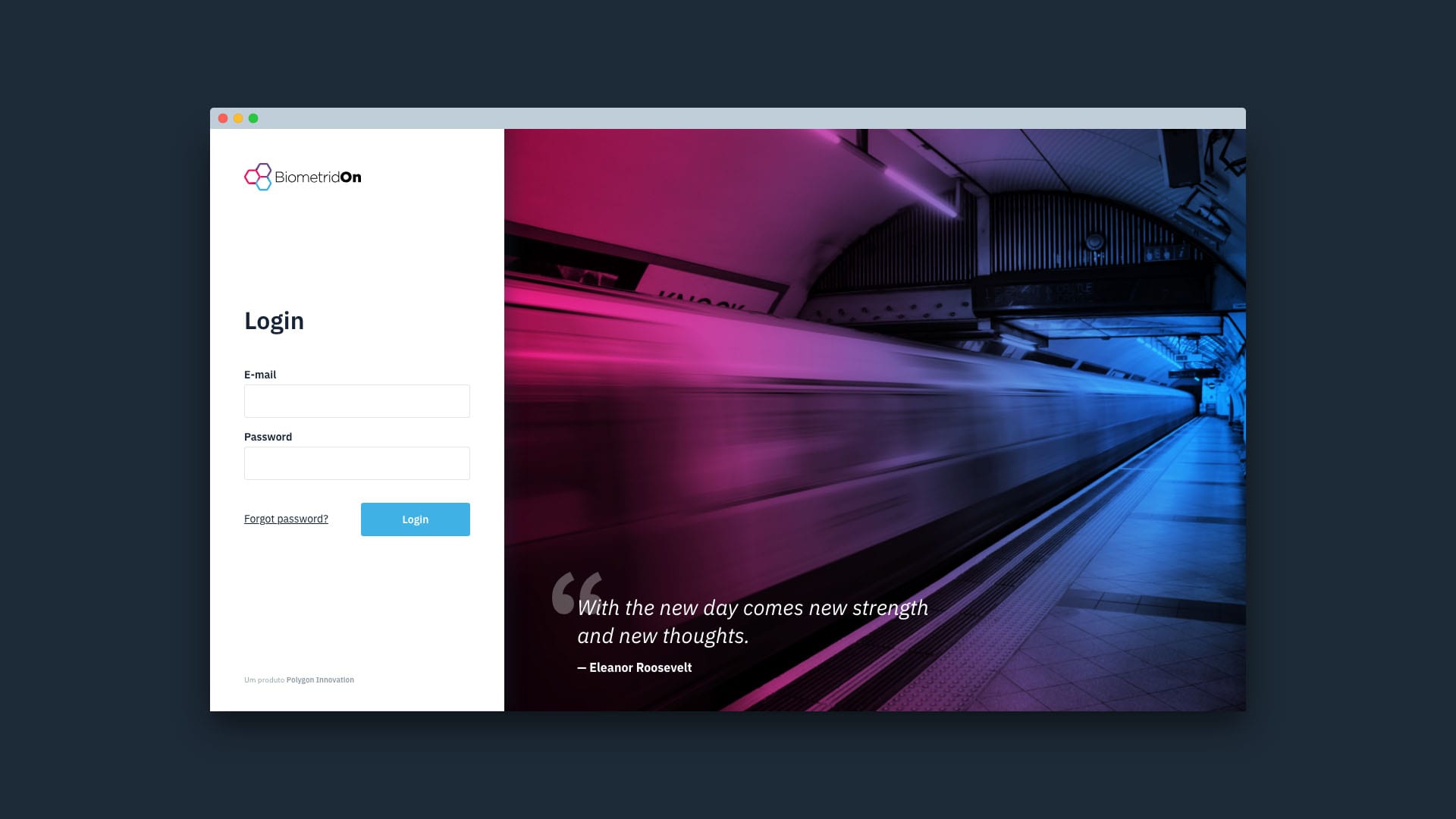

Biometrid On

Building a customer onboarding platform for businesses that need a way to digitalize and verify customers identity.

Brief

"Wouldn't be awesome opening a bank account in the comfort of your couch?" - This was our mission, to create a product that would enable companies to give the opportunity for their clients to open an account remotely without leaving their couch.

Understanding the problem

Developing a shared understanding of the problem among our team is always our first aim for building a great product from the start. I conducted the initial stakeholder interviews to understand the problem we were trying to solve, including context, the business, the customer and the value proposition.

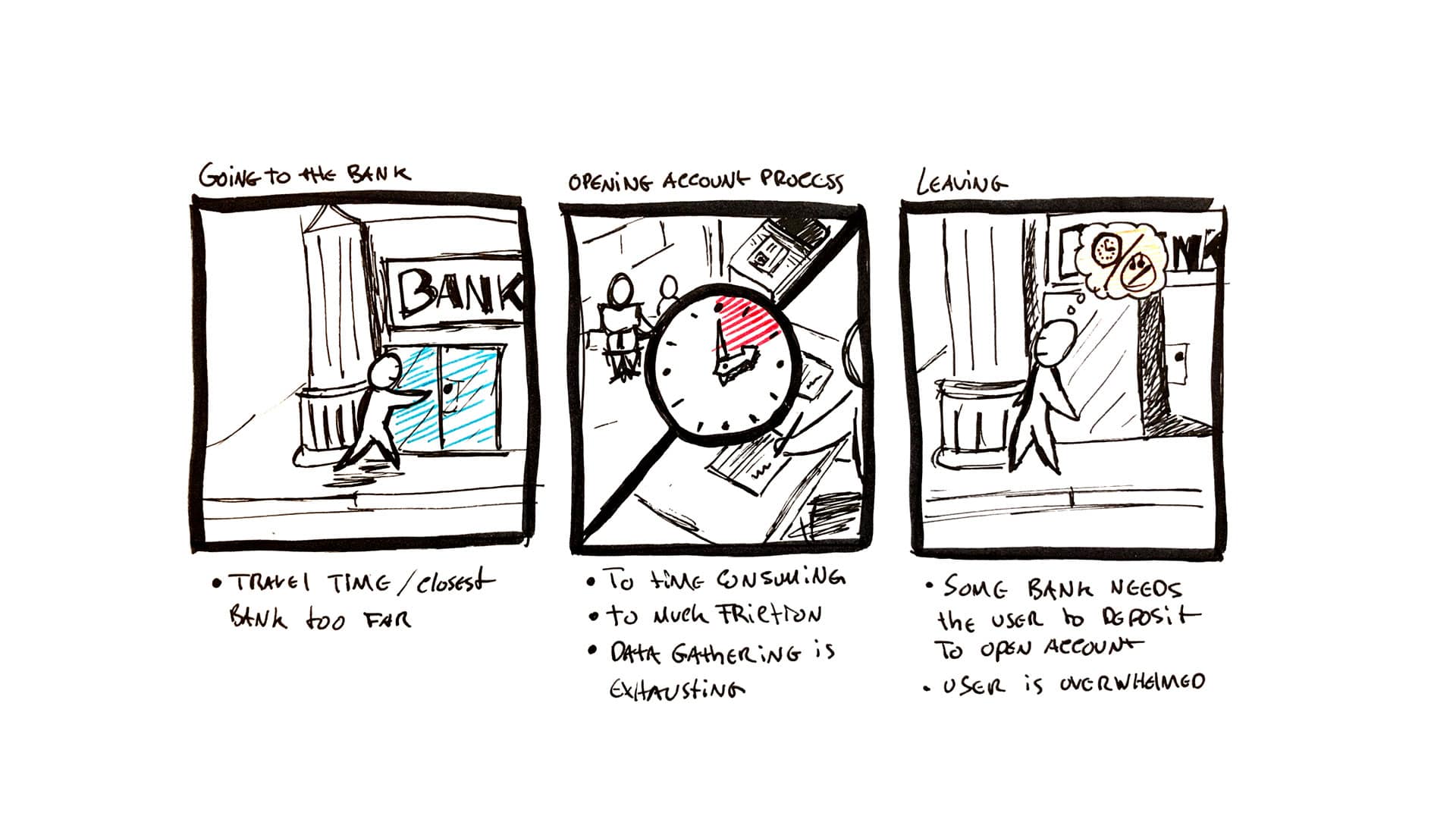

One of the main problems we were trying to solve was the away current users would open a bank account. It was too time-consuming and overwhelming for both, the client and the bank assistant.

This mini storyboard was posted on the wall to remember our team what we wanted to resolve.

Also, other requirements to include in our product was about the law and the new directives from Banco de Portugal which state that, for a person to open a bank account remotely, it would need to do it via video-conference and to provide some sort of one-time-password.

Product challenges

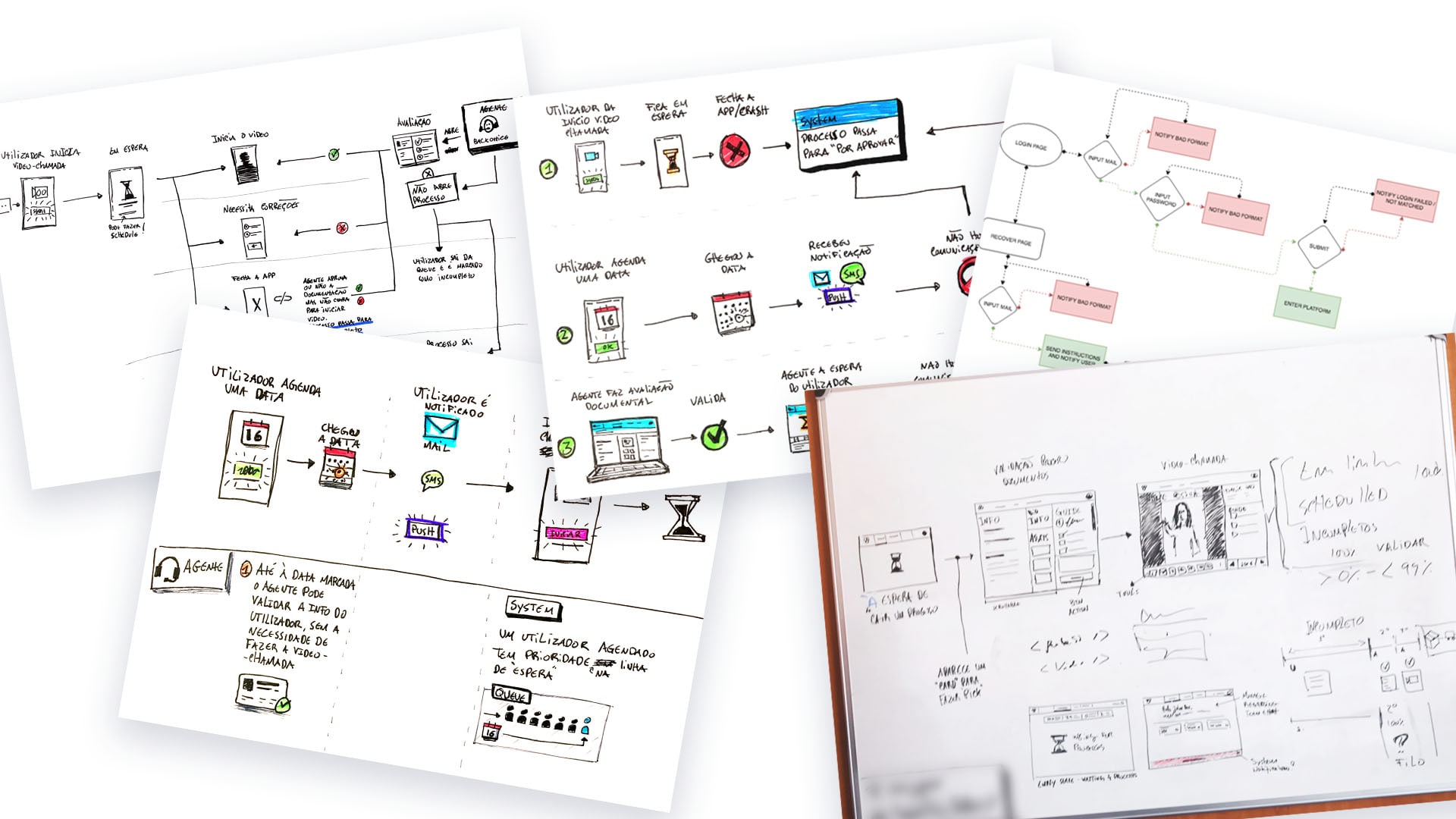

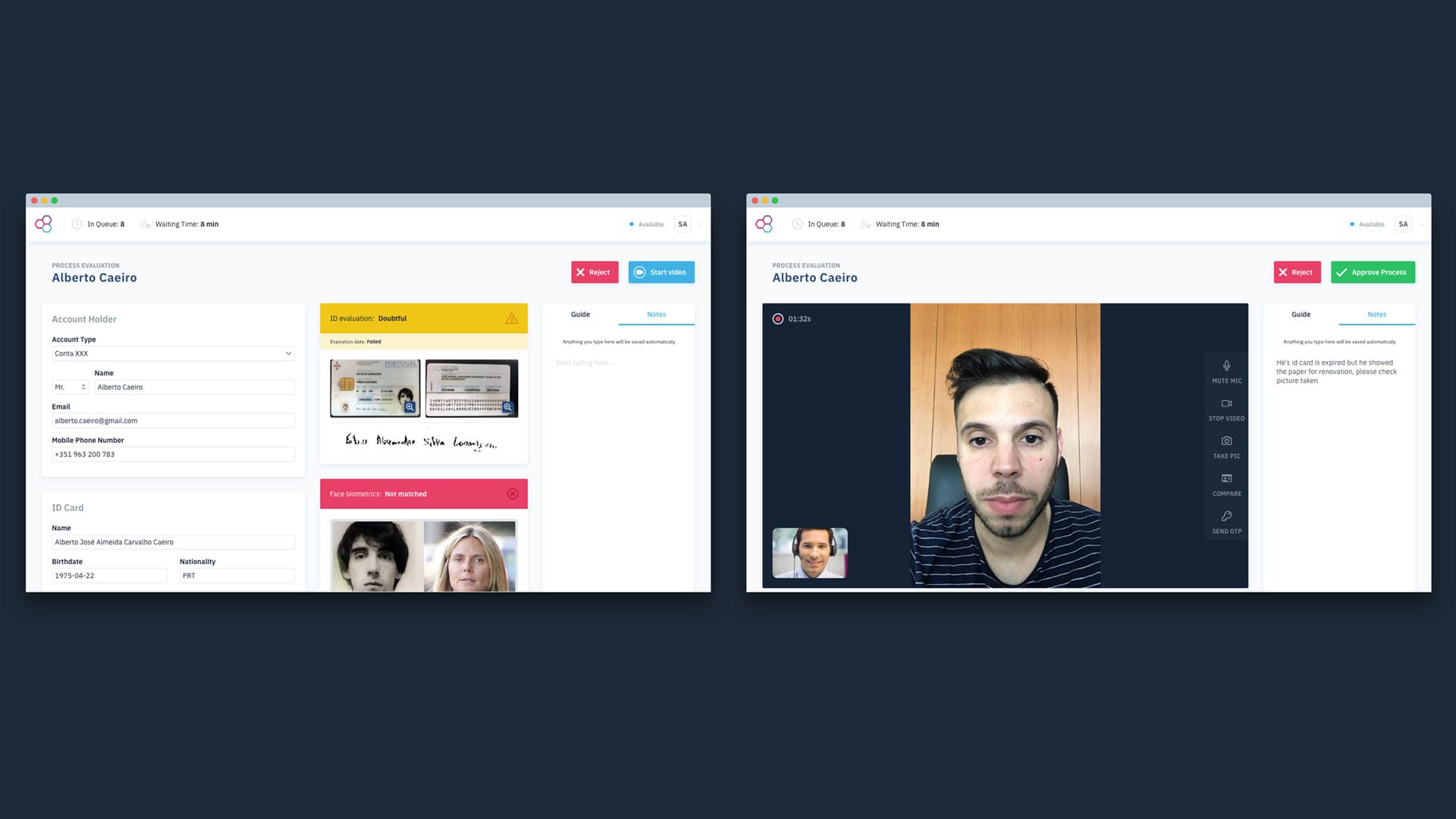

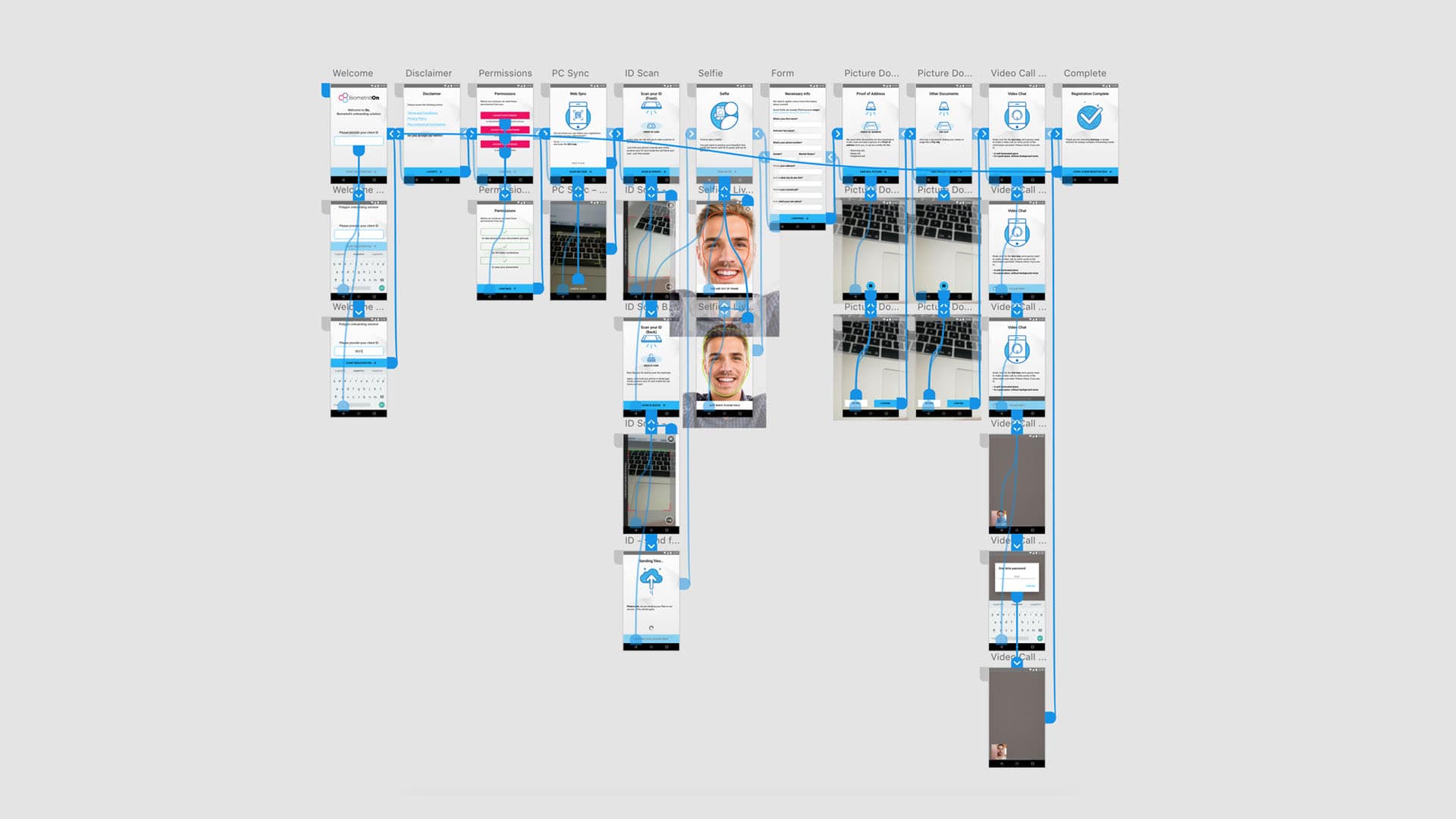

After the initial discussion with the engineering team, it was decided to build the solution as an API (platform agnostic) for the data gathering on the customer (for companies to integrate or create their methods) and a platform (Backoffice) to manage the onboarding processes including the video-conference. To test this, we built a prototype that would be later used for learning and developing the MVP.

Our prototype had to be able to do the following:

- ID card / Passport scanning and other docs for identification/authentication;

- "Selfie" picture

- Video-calls;

- The user could "resume" their initial onboarding process;

- Evaluate queued and scheduled onboarding processes;

- Rejections and reasoning messages for the end user.

Processing the why, how and when

As the initial stakeholder interviews were done and having defined our target audiences, the end user (customer) and the operator (bank assistant) respectively, I started to process for user interviews for seeking their motivations, benefits, needs.

A small drawing explaining where our product would fulfill their need based on a interview I did.

For the operator, it was quite hard for me to get in touch with people that work in banks and manages all the client onboarding, so I went looking for another area that I thought would fit perfectly, call-center operators. I was able to gather some insights even on some procedures how banks work inside, nice!

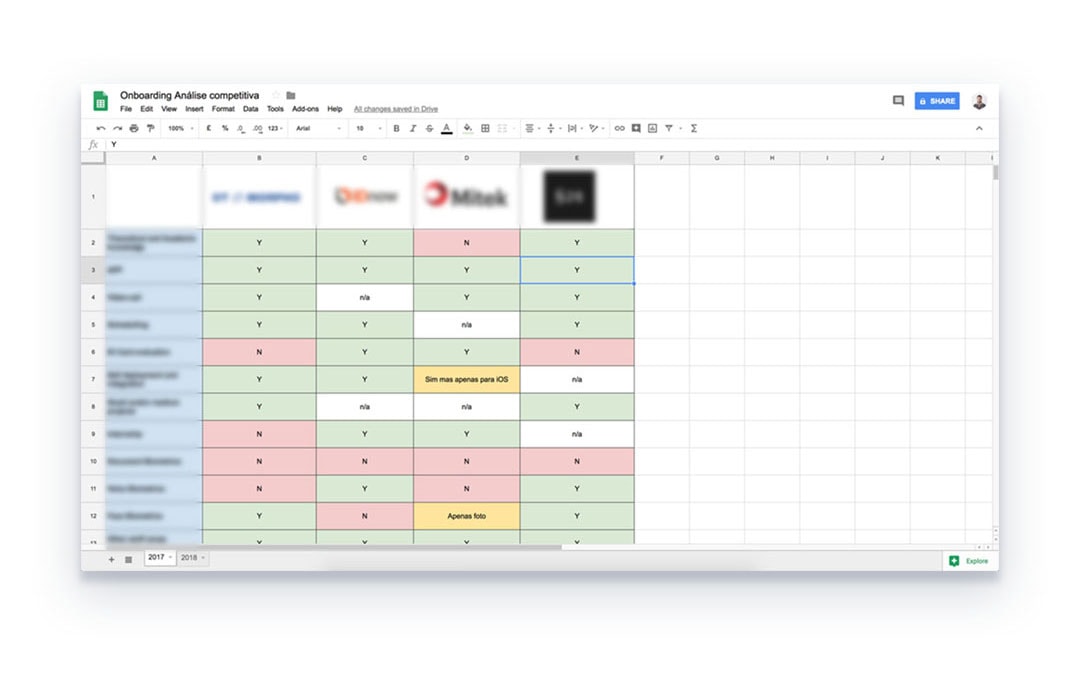

At this point, I started to look for competitors and how currently business/customers were presently solving the problem. The competitive analysis was an arduous process as this was a relatively new concept in the market, but there were some, and it helped me to gain valuable information on current solutions.

Analysis on features

Design and deliverables

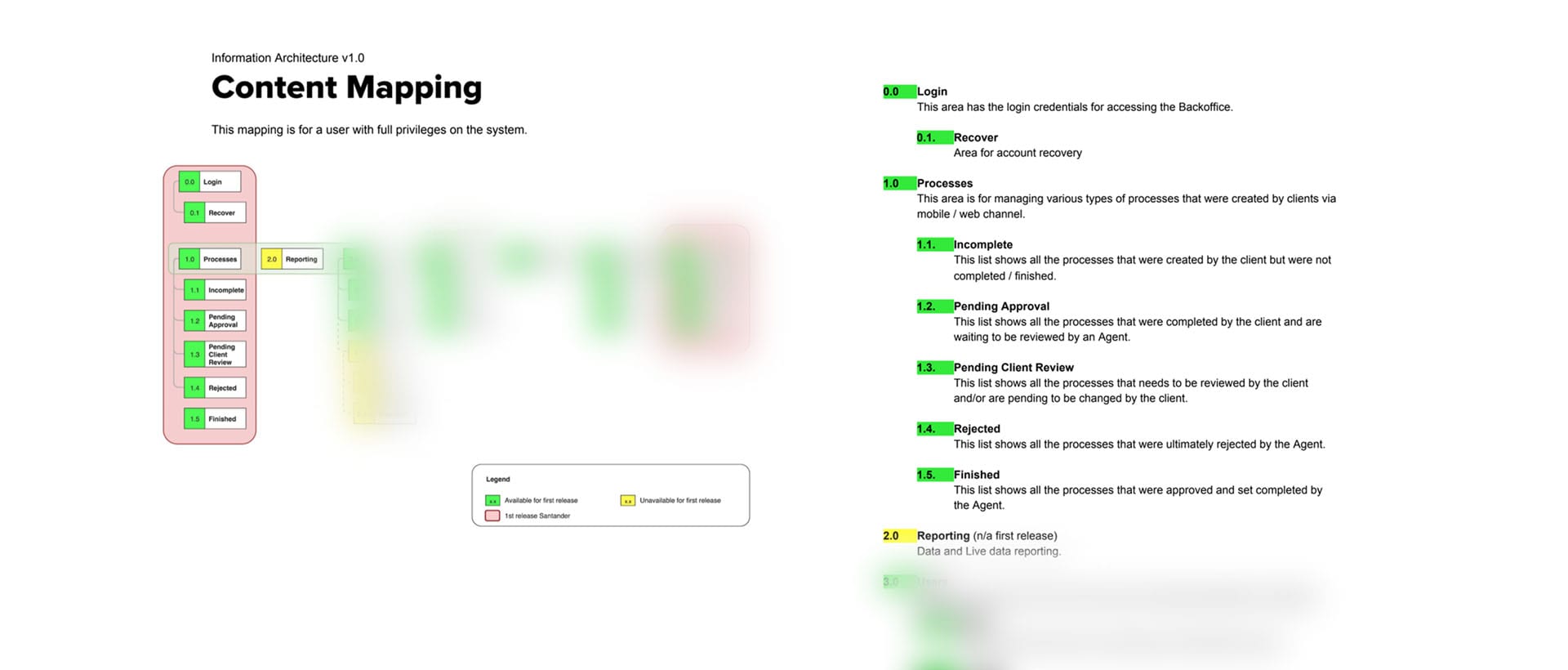

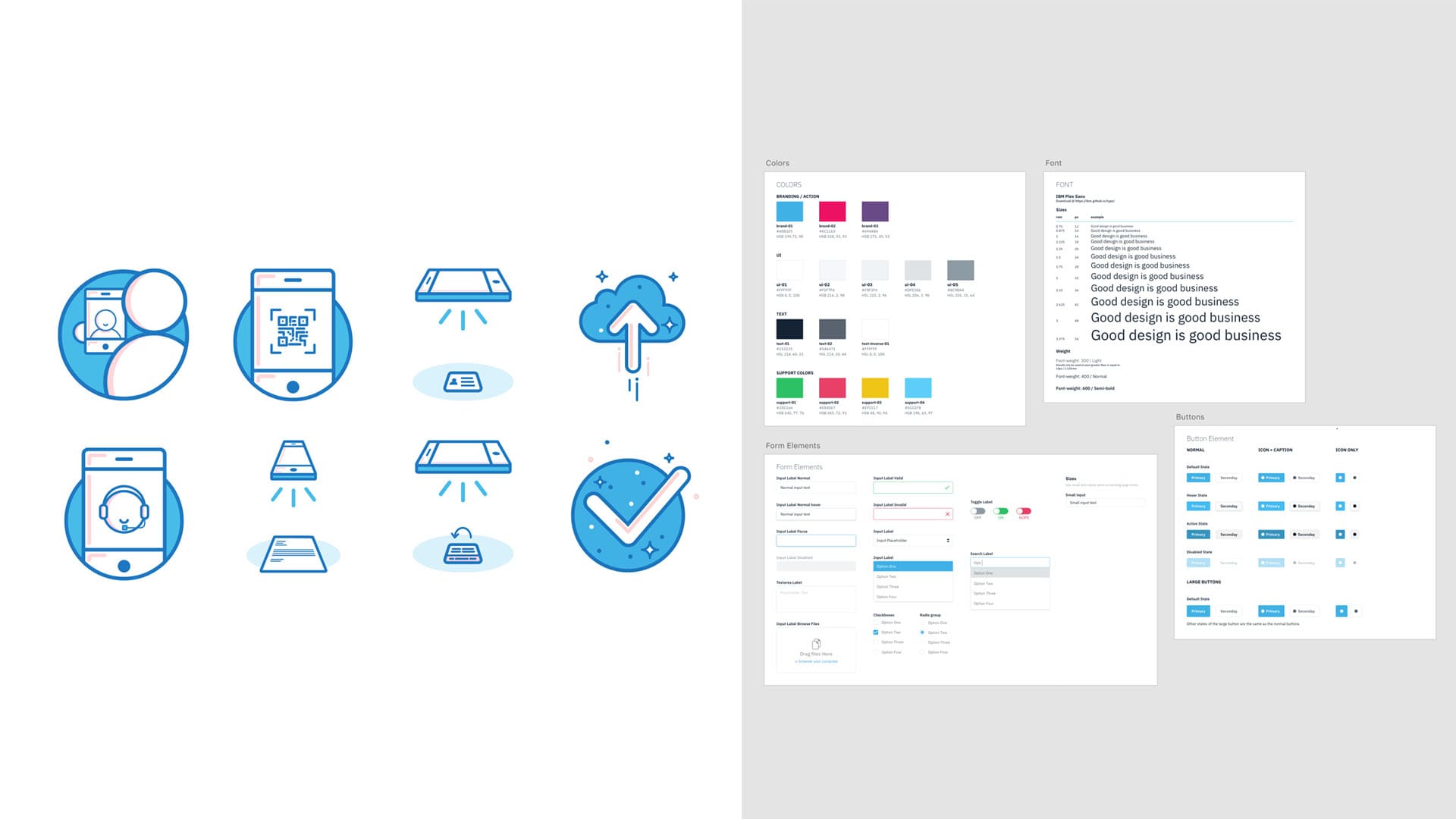

As the only designer in the company, I designed everything from Information architecture, user flows, wireframing and high fidelity prototypes to branding, iconography and a design kit. Seeing what works well and what doesn't is always rewarding. The design process is like a "never-ending story" so upon the prototype, we built an MVP, and we are continuously improving it.

Conclusion

It was an enjoyable project to work, I've learned a lot regarding banking onboarding processes, and it's directives. It is always a pleasure to see a product being built from scratch and all the team effort it involves.

Today, Biometrid On uses Polygon's Biometrid Auth API (multimodal biometrics) as it helps us extend our company mission, and it's being used mainly in the banking sector and some fintech companies.